Jackrabbit uses the cash accounting method for recognizing revenue. For businesses using accrual accounting, moving revenue, deposits, and accounts receivable from Jackrabbit into the accounting system can be accomplished with a few journal entries in your general ledger.

It is not recommended to use the QuickBooks integration in Jackrabbit when your accounting records are accrual based. If you use the integration, the numbers are imported based on cash accounting and will require adjustment in QuickBooks.

Jackrabbit uses cash accounting but also offers accounts receivable tracking = Game Changer! With this insight into the non-cash transactions, transferring data into an accrual based accounting program is no problem.

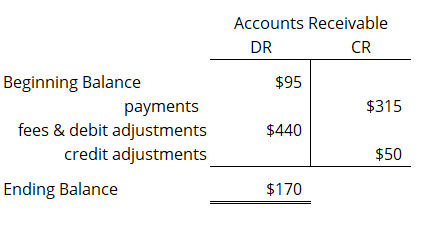

All of the fees and payments that make up each family's balance are tracked in Jackrabbit; this is known as the subsidiary ledger. Your accounting program will only need to use a control account for accounts receivable that reflects the total of all of the family balances in Jackrabbit.

Before You Get Started

There are two accounts that need to be added to your general ledger:

- A current asset account called Accounts Receivable.

This is the control account where journal entries for fees posted and payments received in Jackrabbit will be posted. - A bank account called Deposit Clearing.

Because of timing differences between the deposit of checks and cash (might be held until the end of the week, for example) and ePayments like Visa and Mastercard (hit the bank automatically with 1/2 day lag) it is recommended to use a clearing account to manage them and assist in the reconciliation process.

Use Jackrabbit Reports as a Source for your Journal Entry

Knowing which reports to use is key in getting the right information to fill in the debits and credits of your journal entry.

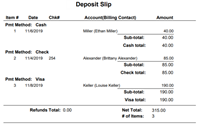

Deposit Slip Report

Payments received from your families will increase your bank balance and decrease your accounts receivable. The Deposit Slip report will provide the amounts received during the time period and the method of payment that was used.

Leave all Search Criteria and Display Settings as the defaults with these exceptions:

- Open the Date from and through to capture the period you are working with.

- Change the Display Setting Show each Transaction to Yes to give you the most detail.

- Change the Display Setting Show Refunds to Cash/Credit Cards Only. A refund of a cash payment or a credit card payment is deducted from the amount to be deposited in the bank and must be considered in the journal entry. Refunds made by check are entered from the check book or bank statement and don't affect the journal entry.

Enter the total amount as one line item to the Deposit Clearing Account in the general ledger and refer to the Deposit Slip report when recording deposits, moving the amounts from the clearing account to the bank account in the general ledger as they actually hit the bank.

| Debit | Deposit Clearing Account | $315 |

| Credit | Accounts Receivable | $315 |

Click on the image to view the supporting Deposit Slip report.

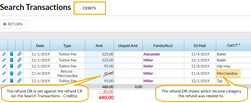

Search Transactions - Debits

When fees are posted to family accounts, or debit adjustments are made, the accounts receivable is increased with debit transactions. Search Transactions (Transactions menu), when filtered for debits only, provides the detail of the revenue to be entered into the general ledger and offset to accounts receivable.

Leave all Search Criteria and Display Settings as the defaults with these exceptions:

- Change the Transaction Date from and through to capture the period you are working with.

- Use the Debits/Credits criteria to select Debits Only.

Sort the results by the Cat 1 column to group amounts to be posted to your revenue accounts. Note: Refunds will appear on both the Search Transactions - Debits and the Search Transactions - Credits and net to zero; do not included these amounts in the journal entry.

| Debit | Accounts Receivable | $440 |

| Credit | Tuition Revenue | $440 |

Click on the image to view the supporting Search Transactions (Debits) report.

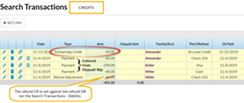

Search Transactions - Credits

When payments are recorded on family accounts, or credit adjustments are made, the accounts receivable is decreased with credit transactions. Search Transactions (Transactions menu), when filtered for credits only, provides the detail of all credits posted during the time period. Credit adjustments in this listing will be entered into the general ledger and offset to accounts receivable.

Leave all Search Criteria and Display Settings as the defaults with these exceptions:

- Change the Transaction Date from and through to capture the period you are working with.

- Use the Debits/Credits criteria to select Credits Only.

This listing will include payments recorded in the previous journal entry made from the deposit slip and don't need to be included in this journal entry. Note: Refunds will appear on both the Search Transactions - Debits and the Search Transactions - Credits and net to zero; do not included these amounts in the journal entry.

| Debit | Expense Account (for account credits) | $50 |

| Credit | Accounts Receivable | $50 |

Click on the image to view the supporting Search Transactions (Credits) report.

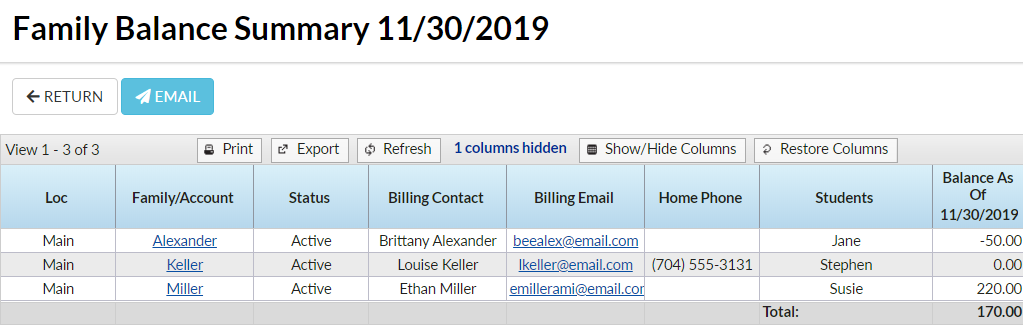

Family Balance Summary Report

When all fees, debit adjustments, payments, and credit adjustments have been posted to the accounts receivable control account in your general ledger, the balance can be verified with Jackrabbit's Family Balance Summary report.