- Family paid for tuition fee and purchased a t-shirt but was charged for two t-shirts in error.

- They have a $0 balance.

- One t-shirt ($20) will be refunded using the organization's check #10300.

- The family balance will remain at $0.

- Nothing will be added back to inventory.

- Click the R icon on the payment line.

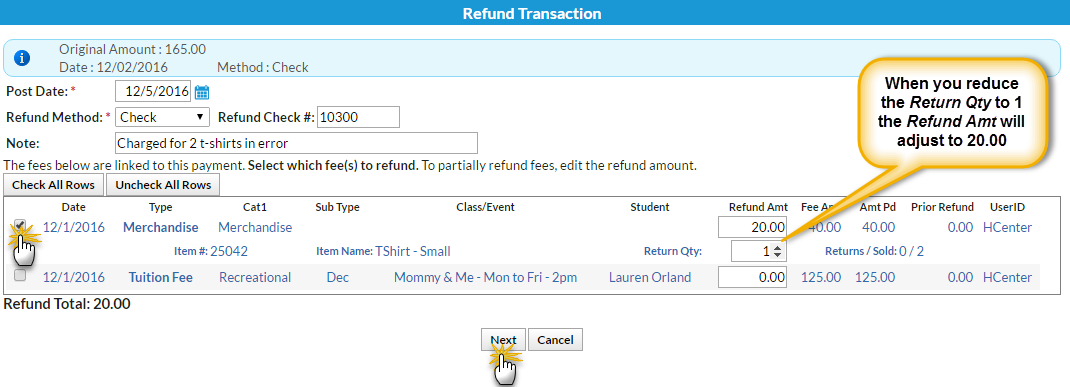

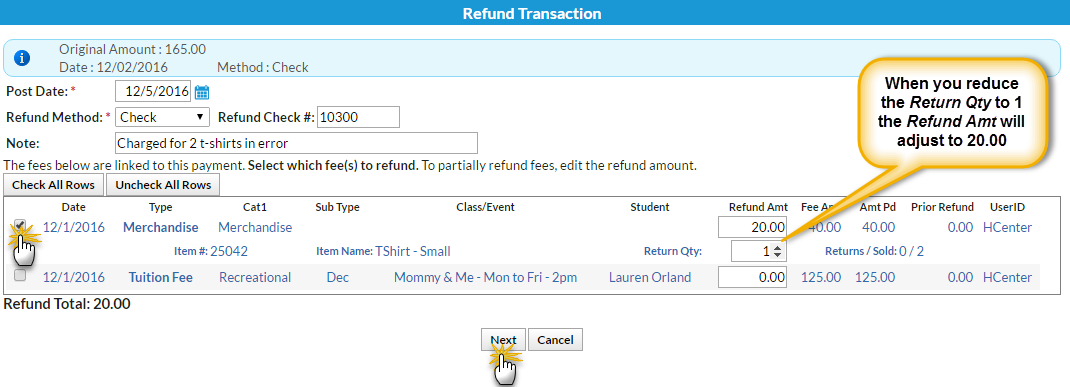

- If needed, change the Post Date.

- Select Check from the Refund Method drop-down and record the Refund Check #.

- Because the tuition fee is not being refunded, leave it unchecked.

- Check the Merchandise and change the Return Qty to 1. The Refund Amt will adjust to 20.00.

- Click Next.

- Store items cannot be marked as still due and the tuition fee was not selected for refund. Click Next in the Are Fees Still Due? window.

- Because the item will be added back to inventory leave Add Back Qty on Hand checked in the Are Items Going Back Into Inventory? window.

- Click Submit Refund.

On the Family's Transactions tab ...

- A Refund - Merchandise has been added for $20 and a Refund Adjustment has been added so that the family's balance is correct.

- The family balance remains at $0.

- The R icon is is still visible for the payment because it has not been completely refunded.

On the Sales Detail store report ...

- The return of the t-shirt is recorded. (The Qty returned has been added back to the item's Qty on Hand.)