Jackrabbit allows you to enter a default tax setting for fees/services as well as goods/products.

The settings below are only for fees and services. To edit tax charged on good/products you sell using Jackrabbit's POS/Store functionality go to

Tools

>

Edit Settings > Drop-down Lists > Item Tax Rates. See the Store Set Up section for more information.

- Go to Tools and click Edit Settings.

- Scroll down on the main page (Organization Defaults) to the Tax Settings section.

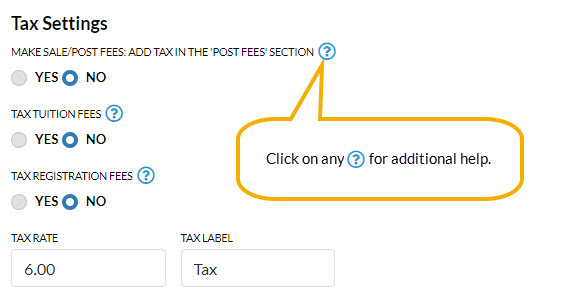

- Set Make Sale/Post Fees: Add tax in the "Post Fees" section to Yes to calculate tax automatically in the Make Sale/Post Fees window, Post Fees section. The Post Fees section is used to post any type of fee, including non-service fees (goods/products/merchandise).

- Set Tax Tuition Fees to Yes only if you tax tuition (class fees).

- Set Tax Registration Fees to Yes only if you tax registration fees.

- Set Tax Rate to the appropriate tax rate percentage (Example: 8.7500).

- Enter a name for taxes in the Tax Label field. (Examples: Sales Tax, GST, etc.) This tax label will appear in sections of Jackrabbit where a tax label is generated. (If you don't enter a label, Jackrabbit will use the word Tax in areas where a label is generated.) Save Changes.