The Store Item Tax Report displays a report of total sales on items.

From the Reports menu > Store, select Store Item Tax. From the Report Type drop-down, select Item Tax.

- Evaluate net sales for a selected time period.

- Report on sales tax for a given month.

- Analyze discounts given on merchandise.

Business Scenario

Your accountant would like to know how much sales tax you collected for the previous month (e.g., April 2019). Run the Store Item Tax Report using the Date Paid From as 4/1/19 and Through as 4/30/19. Export the report to Excel and save. You can then email your accountant with the report attached.

Search Criteria

Use the Search Criteria to narrow the report results:

- If you have multiple locations in your database, you have the option to look at items based on the location of where the item was sold using the Location drop-down.

- Choose additional information you would like to filter the results by such as Vendor, Category 1, Transaction Date, etc.

Leaving a criteria selection blank is the same as saying 'all'.

The Report Results

The Sales Tax comes from the actual tax from each transaction. If the tax was edited in a transaction, it is possible it may not calculate to be the same as the default tax rate multiplied by the total item price.

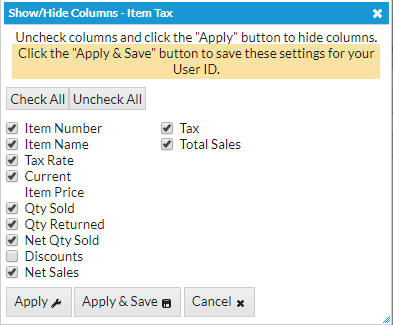

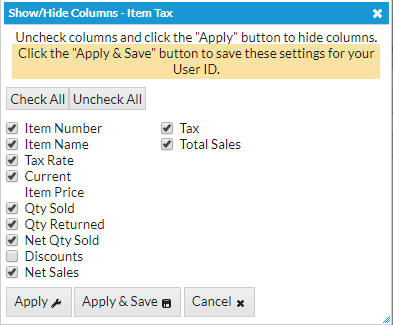

- The Show/hide Columns button allows you to customize your report by selecting which information to display.

- Select Apply to have these selections applied to only the report you are currently viewing.

- Select Apply & Save to have these selections applied and saved to your User ID. When logged in as your User ID, you will see only the columns of information you chose previously. Other Users will see the columns they selected and saved, which may differ from yours.

- Use Restore Columns to view all available columns.